They now dictate the terms (prices and maximum discounts) that normal retailers have to sign up to if they want to sell Apple products

Apple opened their own stores (online and brick-and-mortar) to reduce their retailer’s power.Large retailers, such as Amazon, Walmart) have enormous power over their suppliers.Platform business models can help reduce search costs.

Comparison and review pages, on the other hand, can erode this power. This can lead to the company with the biggest marketing spend exert power over the customer. Products can be opaque or complex (insurance anyone?) The buyer may not have enough info to make good cost-benefit tradeoffs. In an undifferentiated product category with many alternates, incremental product upgrades/evolution may be mostly captured by customers without the ability to increase margins considerably. Buyers will have the upper hand in particular where there are many competing products all competing products have pretty much the same value proposition), competition will be all about the price. Where products are not differentiated (i.e. Who will pay for this? The customer or the seller? Who in the short and who in the long run? Some sellers may switch immediately so they can use it for advertising reasons or offer it as optional (payable) component in the early days Interesting questions arise when regulations stipulate higher safety or environmental standards (often giving a multi-year switch window). Suppliers will generally pass their switch costs onto the buyer in the long run but economies of scale play a big role in this discussion as low scale will require higher unit cost increases (or longer amortisation times and profit compression). If the market moves on they may find having to discount their lower performant or quality products more than they had anticipated

Comparison and review pages, on the other hand, can erode this power. This can lead to the company with the biggest marketing spend exert power over the customer. Products can be opaque or complex (insurance anyone?) The buyer may not have enough info to make good cost-benefit tradeoffs. In an undifferentiated product category with many alternates, incremental product upgrades/evolution may be mostly captured by customers without the ability to increase margins considerably. Buyers will have the upper hand in particular where there are many competing products all competing products have pretty much the same value proposition), competition will be all about the price. Where products are not differentiated (i.e. Who will pay for this? The customer or the seller? Who in the short and who in the long run? Some sellers may switch immediately so they can use it for advertising reasons or offer it as optional (payable) component in the early days Interesting questions arise when regulations stipulate higher safety or environmental standards (often giving a multi-year switch window). Suppliers will generally pass their switch costs onto the buyer in the long run but economies of scale play a big role in this discussion as low scale will require higher unit cost increases (or longer amortisation times and profit compression). If the market moves on they may find having to discount their lower performant or quality products more than they had anticipated #What is threat of new entrants upgrade#

Say they decide to not undertake one such upgrade as they don’t anticipate sufficient return. steel, fuels, other commodities, electronic components, etc).

Manufacturers can face switching costs for upgrades of their productive assets to produce higher quality or higher performance outputs (e.g. Where suppliers face switching costs buyers have more leverage Customer switch costs are more prominent (explaining this below). Seller’s (supplier’s) switching costs: Switching costs can affect both sides, suppliers and customers (=buyers).

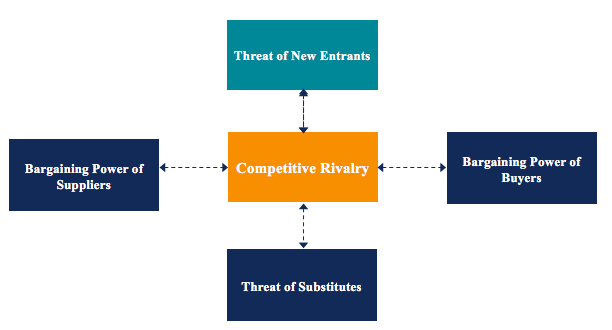

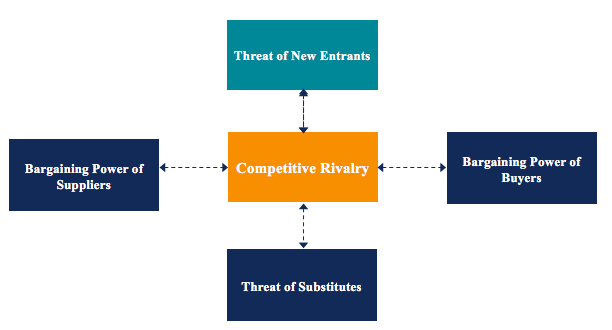

Here is an image of Apple’ supply chain.įactors that influence buyer bargaining power: They are also a buyer of the assembly services of huge companies like Foxconn who are producing about 40% of all electronics world-wide and employ 1.3 million employees. Apple is a seller to the end customers but they are also a buyer of components, such as displays, graphic processing units (GPUs), system on a chip (SoC). When you read the below remember we are not just talking about end-buyers (=consumers). We might be talking about negotiations as such, say a large multi-year supply contract or a supply contract for smartphone components. Bargaining power can also be exercised indirectly through purchase decisions of end customers, i.e buying from the lowest-priced company, deferring the purchase for a prolonged period, buying pre-owned (e.g. Where sellers have too much power over buyers opportunities can emerge for others.īargaining power can be exercised in different ways. Buyer power can lead to lower prices or having to increase costs by adding features, services, quantity in order to sell. Where buyers are powerful profits are generally lower.

0 kommentar(er)

0 kommentar(er)